REAL TIME NEWS

Loading...

Title USOUSD H4 | Bullish continuation setup Type Bullish bouncePreference The price could fall towards the pivot at 64.02, which is a pullback support that aligns with the 23.6% Fibonacci retracement. A bounce from this level could lead the price toward the 1st re...

Title USOUSD H4 | Bullish continuation setup Type Bullish bouncePreference The price could fall towards the pivot at 64.02, which is a pullback suppor

Title GBPCAD H4 | Bearish drop offType Bearish reversal Preference The price could rise towards the pivot at 1.8677, an overlap resistance. A reversal at this level could lead the price toward the 1st support at 18542, an overlap support. Alternative Scenario If th...

Title GBPCAD H4 | Bearish drop offType Bearish reversal Preference The price could rise towards the pivot at 1.8677, an overlap resistance. A reversal

Title EURGBP H4 | Bearish momentum to continue Type Bearish drop Preference The price is rising towards the pivot at 0.8697, which is an overlap resistance. A reversal from this level could lead the price toward the 1st support at 0.8656, a multi-swing low support....

Title EURGBP H4 | Bearish momentum to continue Type Bearish drop Preference The price is rising towards the pivot at 0.8697, which is an overlap resis

USD ReboundingThe US Dollar continues to stabilise ahead of the weekend with the DXY bouncing back off the weekly lows printed on Tuesday. Much of the rebound appears linked to news that Trump will announce his new Fed chair nominee today, expected to be Kevin Wars...

USD ReboundingThe US Dollar continues to stabilise ahead of the weekend with the DXY bouncing back off the weekly lows printed on Tuesday. Much of the

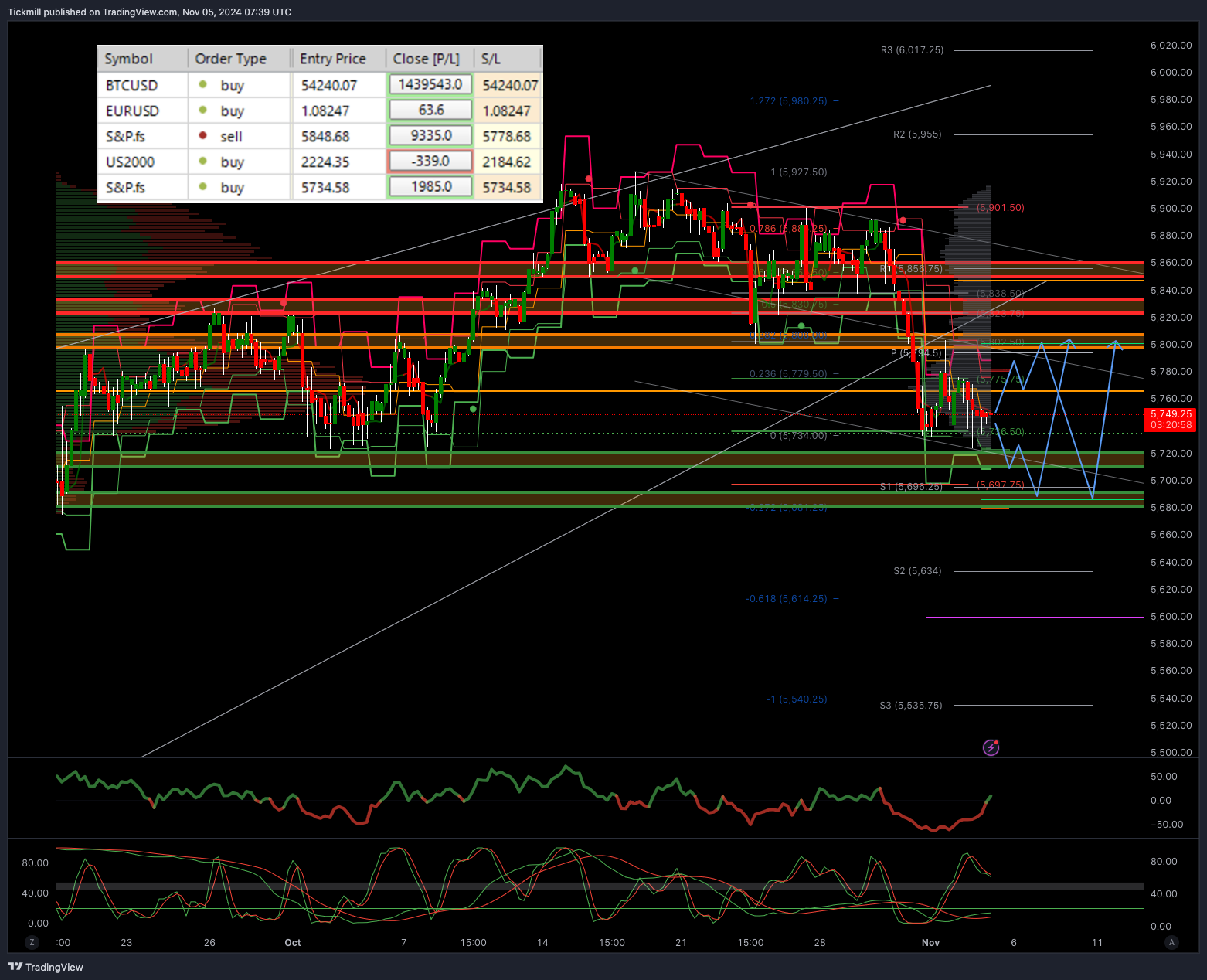

Nomura Cross Asset Management - US equity indices (SPX / NDX / QQQ / RUT)** actionable positioning, hedging, and triggers.---## 1) Market regime implication: crowded-long + low-vol dependenceThe note’s key equity message is that systematic trend (CTA) is extremely ...

Nomura Cross Asset Management - US equity indices (SPX / NDX / QQQ / RUT)** actionable positioning, hedging, and triggers.---## 1) Market regime impli

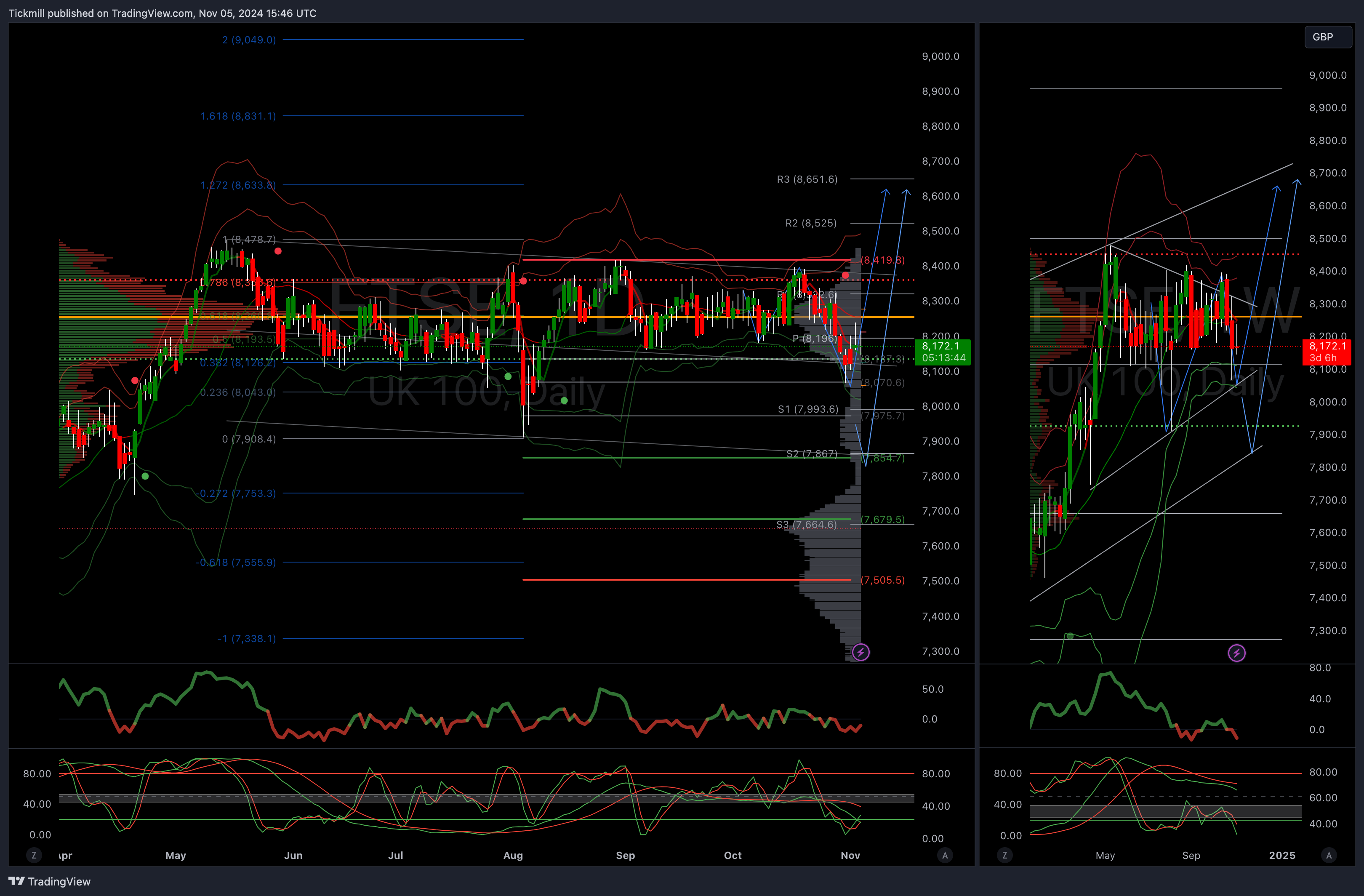

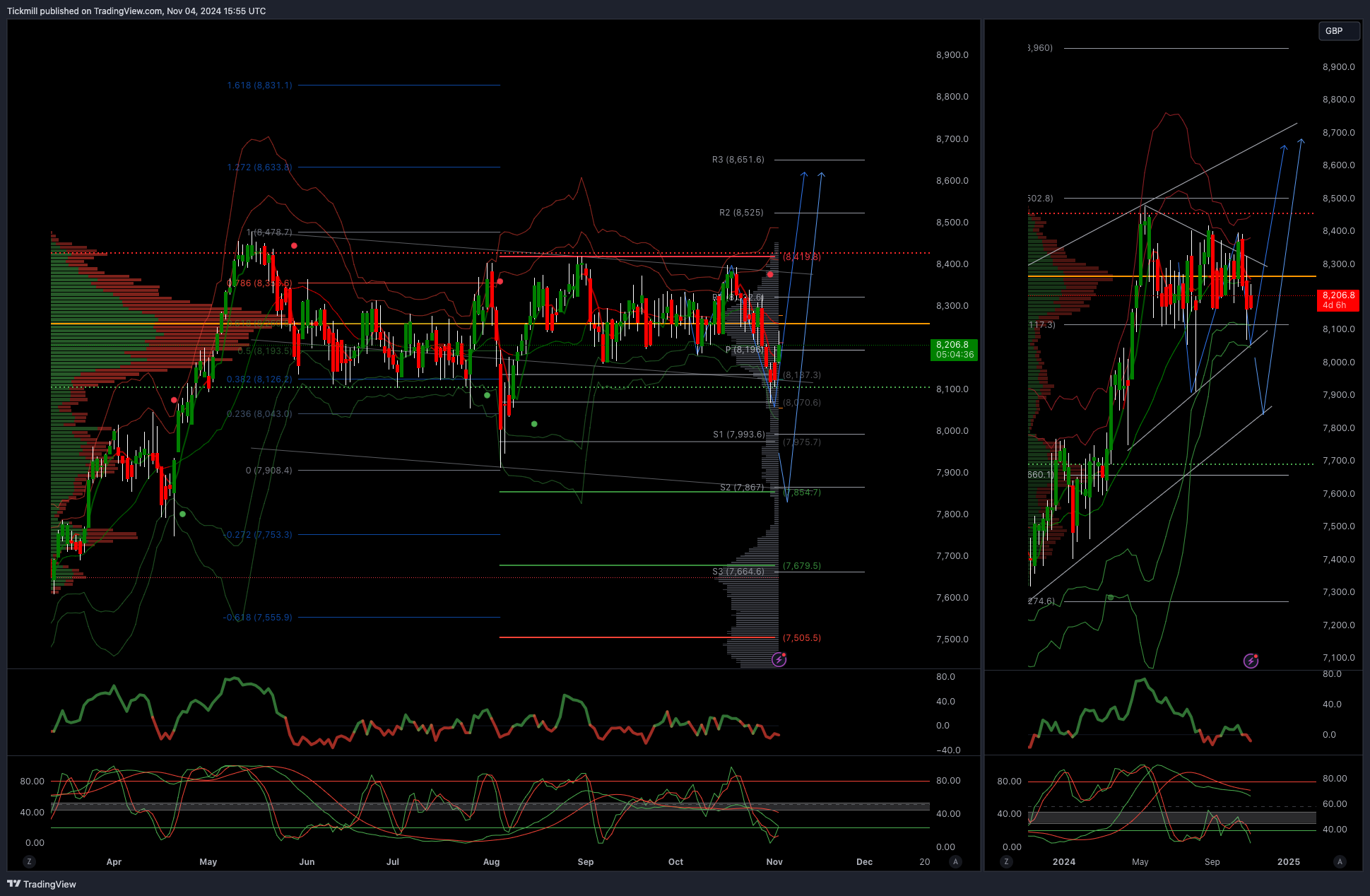

Daily Market Outlook, January 30, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Markets took a hit as both stocks and US Treasuries declined amid growing speculation that President Trump is leaning toward nominating Kevin Wa...

Daily Market Outlook, January 30, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Markets took a hit as both st

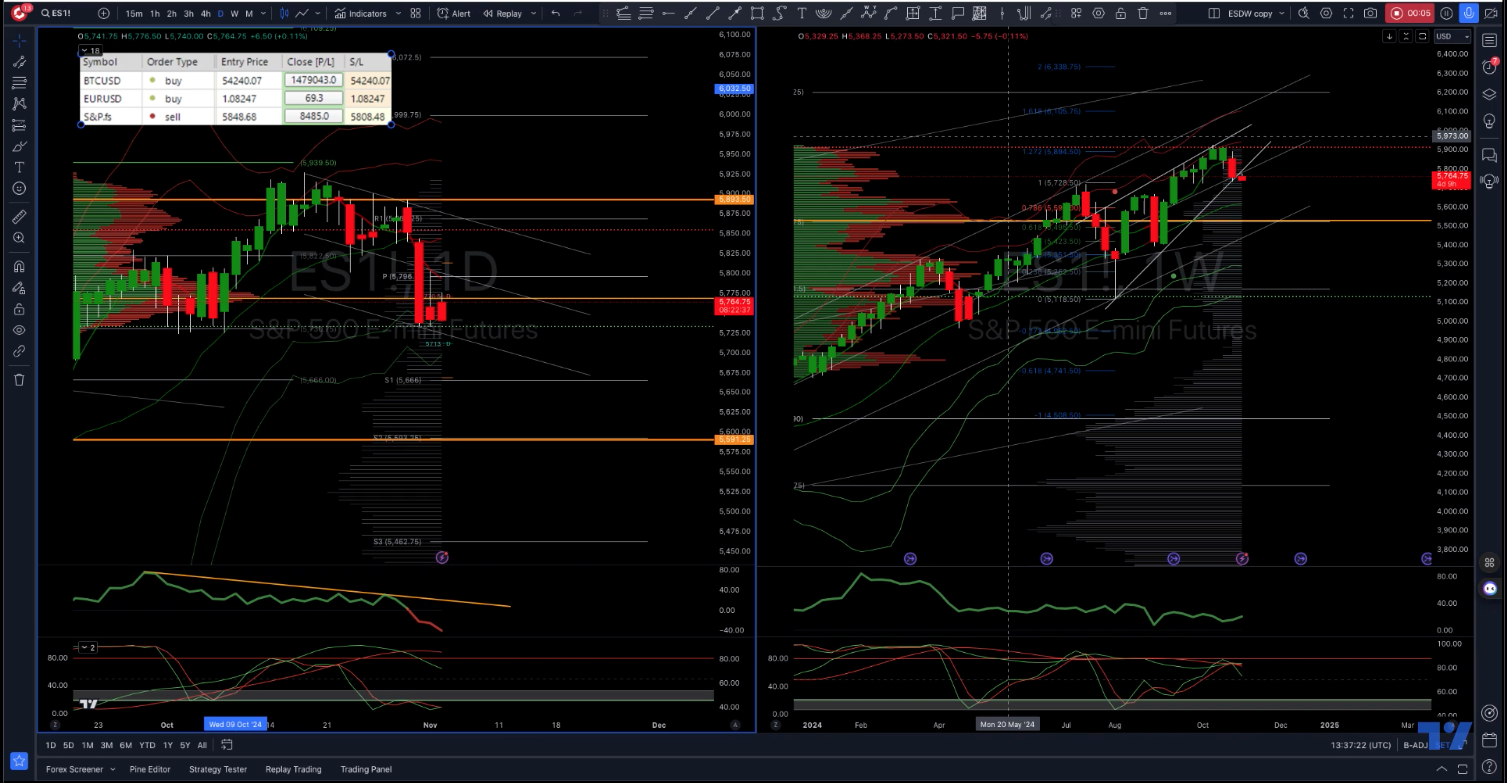

DXY, ES1, NQ1 & GC1 Daily Trade SetupsIn this update we review the recent price action in the Dollar, SP500, Nasdaq & Gold futures markets and identify the next high-probability trading opportunities and price objectives to target. To review today's vi...

DXY, ES1, NQ1 & GC1 Daily Trade SetupsIn this update we review the recent price action in the Dollar, SP500, Nasdaq & Gold futures markets and

Volatile Price ActionCopper prices are on watch ahead of the weekend following a heavy reversal lower from the all-time highs printed yesterday. The futures market hit highs of 6.5850 before sharply reversing 10% lower. The move has been linked to profit taking as ...

Volatile Price ActionCopper prices are on watch ahead of the weekend following a heavy reversal lower from the all-time highs printed yesterday. The f

Title AUDCHF H1 | Potential bearish reversal Type Bearish reversal Preference The price is rising towards the pivot at 0.54093, an overlap resistance that is slightly above the 61.8% Fibonacci retracement. A reversal from this level could lead the price toward the ...

Title AUDCHF H1 | Potential bearish reversal Type Bearish reversal Preference The price is rising towards the pivot at 0.54093, an overlap resistance

SP500 LDN TRADING UPDATE 30/1/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6880/70WEEKLY RANGE RES 7065 SUP 6928FEB OPEX STRADDLE 6726/7154MAR QOPEX STRADDLE 6466/7203DEC 2026 OPEX ST...

SP500 LDN TRADING UPDATE 30/1/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEA