Dollar Falls as Polls Show Harris Leading Trump

The greenback experienced a notable decline on Monday, erasing Friday's gains and dipping lower across the board. This movement comes on the heels of new election polls that indicate Vice President Kamala Harris leading former President Donald Trump. An ABC News and Ipsos poll shows Harris ahead by 49% to Trump's 46%. A Trump victory is generally seen as positive for the US Dollar due to his stance on trade, where tariffs and protectionist measures would likely bolster domestic industries and reduce imports, potentially strengthening the dollar. Additionally, his administration has historically favored fiscal stimulus, including tax cuts and increased government spending, which can boost economic growth and support the USD by raising interest rates and attracting foreign investment. Markets may also anticipate tougher foreign policy and economic sanctions under Trump, which could create dollar demand as a safe-haven currency.

Friday's labor market report revealed a stark miss in Non-Farm Payrolls, with only 12K jobs added versus the expected 106K. Surprisingly, the USD remained resilient, showing limited negative reaction. The unemployment rate held steady, and markets attributed the disappointing NFP figures to temporary factors such as adverse weather conditions rather than underlying economic weakness. The muted response of the USD to the weak NFP data underscores the market's focus on transient versus structural economic factors.

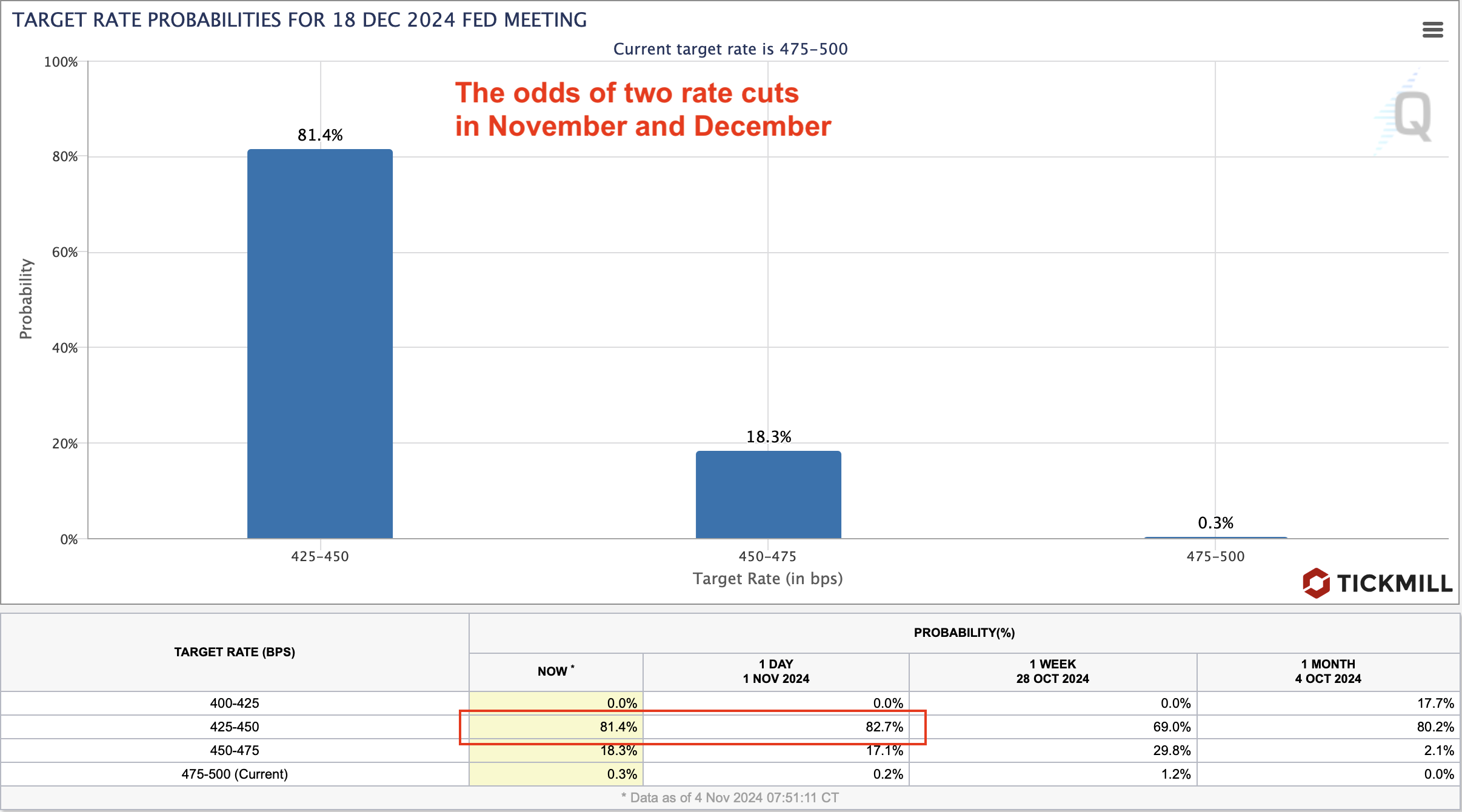

Attention now shifts to the Fed's policy decision scheduled for Thursday. The consensus expectation is for a 25 basis point rate cut, following a larger-than-usual 50 bps reduction in September that initiated the current easing cycle.

December implied rate cut odds have shifted marginally, now at 81.4% compared to 82.7% last week. This slight change indicates that market expectations for Fed easing remain relatively stable despite the weak NFP report:

The EUR/USD chart shows a clear recovery trend, with recent price action rebounding from the lower trendline support around 1.078. The pair is targeting a recovery toward the resistance at 1.10 indicated by the red circle, which aligns with the 50-day moving average and could act as a potential barrier. A successful break above this level would signal strength and open the path toward the upper channel resistance near 1.1250:

The British Pound has gained sharply against the USD, bracing for a breakout above 1.30 after failed breakdown below the key support trendline:

The pair is attempting to establish a solid position above the key support ahead of the Bank of England's policy meeting. The BoE is widely expected to cut interest rates by 25 bps to 4.75%. Out of the nine-member Monetary Policy Committee, seven members are anticipated to vote in favor of the cut, with two preferring to maintain rates at 5%. Notably, external MPC member Catherine Mann is likely among those supporting unchanged rates.

Investors will closely monitor Governor Andrew Bailey's post-decision press conference for insights into future policy direction. Additionally, the BoE's assessment of the Annual Forecast Statement presented by the Labour government will be scrutinized for its potential impact on the inflation outlook and interest rate trajectory into next year.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.