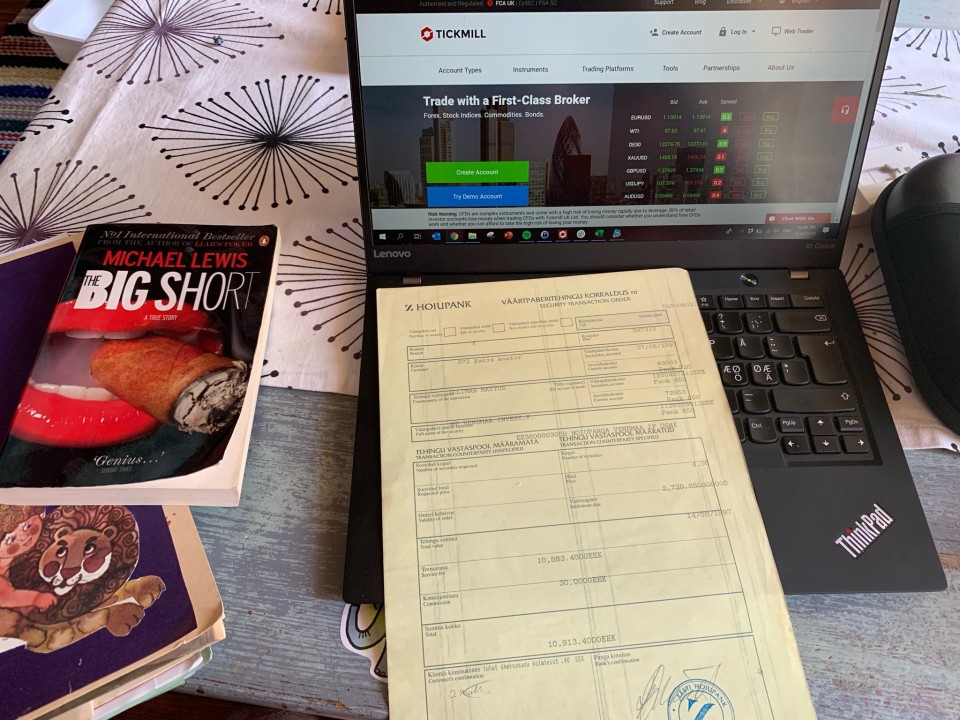

Illimar Mattus

Illimar has been trading the financial markets since 1997 and is fascinated about the opportunities it presents to traders. He first started investing in emerging markets and then gradually moved to the U.S. stock markets. For the last 10 years his focus has been primarily on the US-based FX, commodity and government bond futures and futures options markets.

Favourite trading instruments

- Derivatives: CBOT, NYMEX, COMEX, LIFFE and EUREX;

- Precious metals: gold and silver;

- Futures options of commodities: WTI crude oil, natural gas, grains;

- Soft commodities: orange juice and cocoa.

Preferred market analysis

Illimar employs complex correlation and asymmetric risk-reward strategies on a medium to long-term time horizon.

Trading style

He finds the leveraged spot FX markets riskier than the futures markets but at the same time likes the extra profit potential it gives to the disciplined traders.

I have experienced both ups and downs during my trading career and enjoy sharing this experience with my fellow traders.