Gold Testing Key Fib Extension Level

Gold Pushing Higher

Gold prices continue to soar to fresh record highs this week with the futures market setting a new upper record over early European trading on Tuesday. The dovish shift in Fed expectations on the back of the recent reappraisal of US labour market data has seen traders moving to price in at least 1% of easing ahead of year end. Against this backdrop gold has benefitted steadily and looks poised to advance higher near-term.

US Jobs Re-evaluation

At the beginning of August, the July NFP was seen sharply undershooting market forecasts along with heavy downward revisions to two prior readings. This revaluation of the labour market was seen as dismantling a key pillar of the Fed’s hawkish argument (strong jobs market and lingering inflation risks). Last week, a further heavy downside-miss on the NFP showed that weakness wasn’t just a blip, but something more concerning, fuelling a further rise in easing expectations.

US Inflation Data

Looking ahead this week, traders will be closely watching incoming US inflation data with PPI due tomorrow ahead of Thursday’s headline CPI event. Focusing on CPI, if inflation rises again as expected (2.9% vs 2.7% prior), this could cap the gold rally for now, taming easing expectations a little beyond this month. However, if see any downside surprise, this will be firmly bullish for gold as USD plunges lower on a fresh jump in easing expectations ahead of the September FOMC.

Technical Views

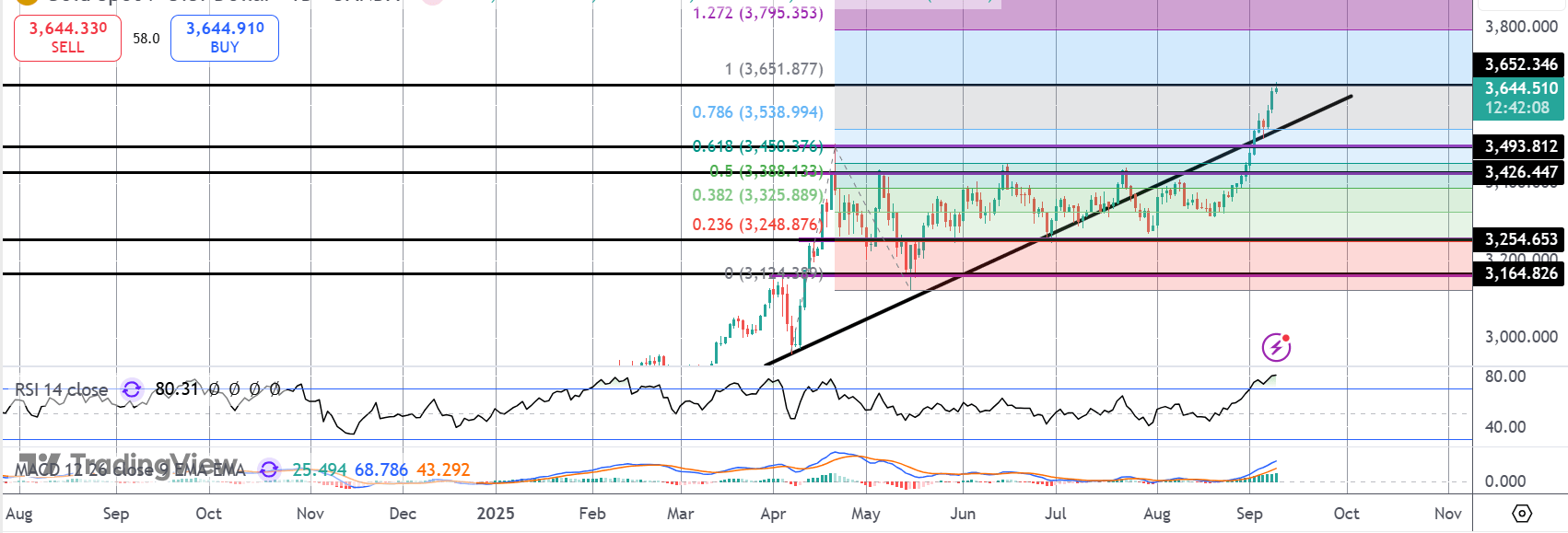

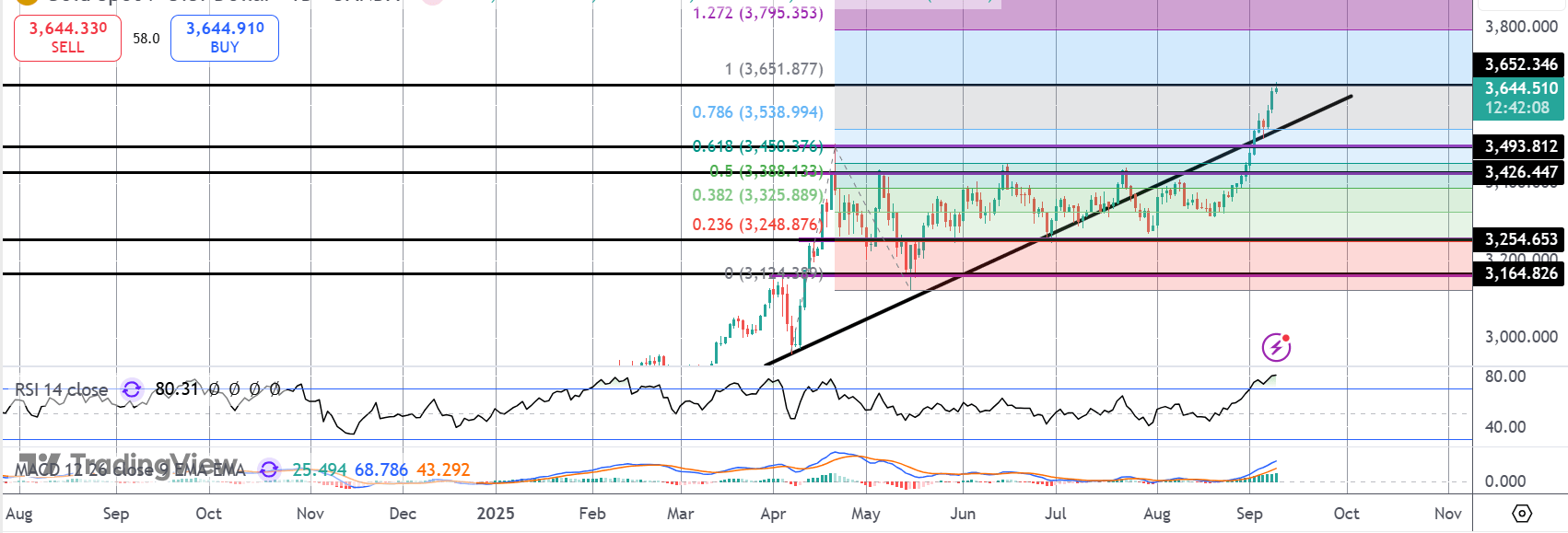

Gold

The rally in gold has traded up to test the 1:1 Fib extension from that initial push higher we saw at the start of the year. While price remains above those initial 2025 highs at 3,943.81, the outlook remains bullish with the 1.27% extension ahead of the 3,800 level the next target for bulls, in line with bullish momentum studies signals.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.