SP500 LDN TRADING UPDATE 11/12/25

SP500 LDN TRADING UPDATE 11/12/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

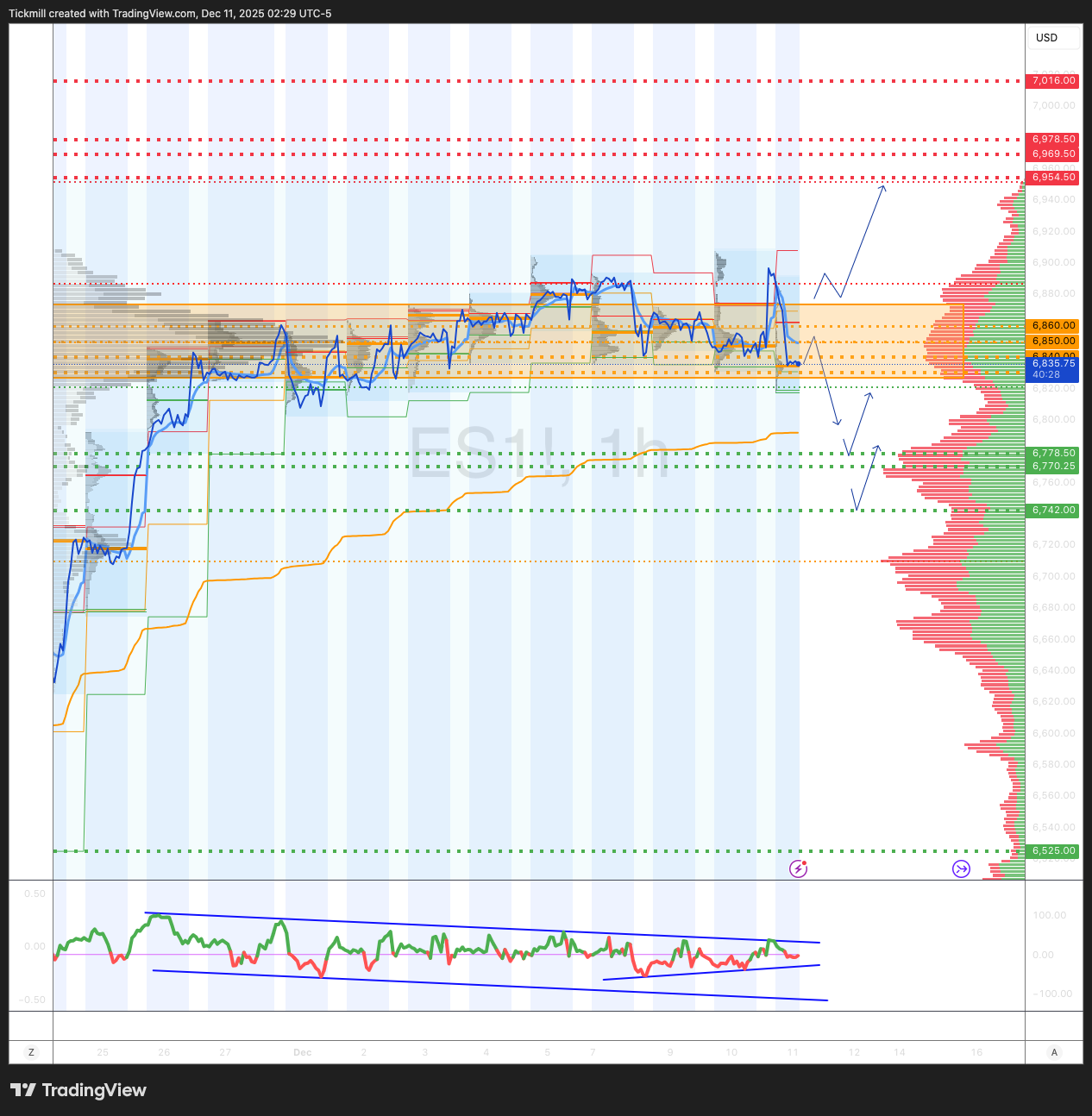

WEEKLY BULL BEAR ZONE 6830/40

WEEKLY RANGE RES 6978 SUP 6778

DEC EOM STRADDLE 6631/7067

DEC QOPEX STRADDLE 7025/6303

WEEKLY VWAP BEARISH 6747

MONTHLY VWAP BULLISH 6761

WEEKLY STRUCTURE – ONE TIME FRAMING HIGHER - 6812

MONTHLY STRUCTURE – BALANCE - 6952/6539

The SPX aggregate gamma flip point is 6780, whereas we are currently at a relative peak around 6950. This indicates that dealers are typically backing the price and will be applying brakes as it fluctuates up and down

DAILY STRUCTURE – BALANCE - 6905/6820

DAILY VWAP BEARISH 6869

DAILY BULL BEAR ZONE 6859/69

DAILY RANGE RES 6954 SUP 6831

2 SIGMA RES 7016 SUP 6770

VIX BULL BEAR ZONE 18.88

PUT/CALL RATIO 1.21

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TRAGET WEEKLY RANGE SUP

LONG ON TEST/REJECT WEEKLY RANGE SUP TARGET WEEKLY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

J.P.MORGAN TRADING DESK VIEW

J.P. Morgan US Market Intel Afternoon Briefing for December 10, 2025.

Top Story: The Fed Decision

The central theme of the day was the FOMC meeting. The market reacted positively ("risk-on rally") as the press conference was "better-than-feared."

The Decision: The Fed cut rates by 25 basis points, as expected.

Powell’s Tone: Chair Powell eased anxiety by stating that a rate hike is not the base case and the Fed is in a "wait-and-see" mode.

Economic Outlook: The Fed upgraded its 2026 GDP forecast significantly (from 1.8% to 2.3%) while citing productivity gains as a driver for growth without spiking inflation.

Liquidity: Treasury purchasing ($40bn/month) begins Dec 12 to manage reserve liquidity, not as stimulus.

Market Performance

Equities: Stocks finished higher.

S&P 500: +0.7%

Nasdaq 100: +0.4%

Russell 2000: +1.3% (Small caps outperformed).

Bonds: Yields fell across the curve (2-year -7bps, 10-year -4bps).

Breadth: The rally broadened beyond Tech. Significant strength (>2 standard deviations) seen in Machinery, Regional Banks, Housing, Airlines, and Retail.

Commodities: WTI Crude +1.15% ($58.92); Gold +0.43%.

Corporate & Earnings Updates

Broadcom (AVGO) Preview: Reporting tomorrow (Dec 11). JPM expects a "beat" driven by strong AI demand (Google TPU ramp, networking chips) and VMware synergies. They see FY25 AI revenue hitting $20-21B+.

Oracle (ORCL): Fell 6.6% in post-market trading due to weak cloud sales.

NVIDIA (NVDA): Underperformed slightly (-1.0%) during the session.

Key Data & Calendar

Tomorrow (Dec 11): Initial Jobless Claims, Trade Balance, and AVGO earnings.

Upcoming Catalysts:

Dec 16: Non-Farm Payrolls (NFP) release.

Dec 18: CPI release.

Data Warning: Powell warned that upcoming NFP/CPI data might be "distorted" due to collection issues, suggesting the market should focus more on the Jan 10 report.

Note: This publication will pause on December 12 and resume in early January.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!