机构洞察:高盛资金流动(FOMO)

-1730196329.jpeg)

机构洞察:高盛资金流动(FOMO)

高盛战术资金流动11月FOMO观察

这个周末我收到了2024年以来最多的问题。这是最后的冲刺,距离2024年交易结束还有44天。以下是我目前关注的10个最重要的点。

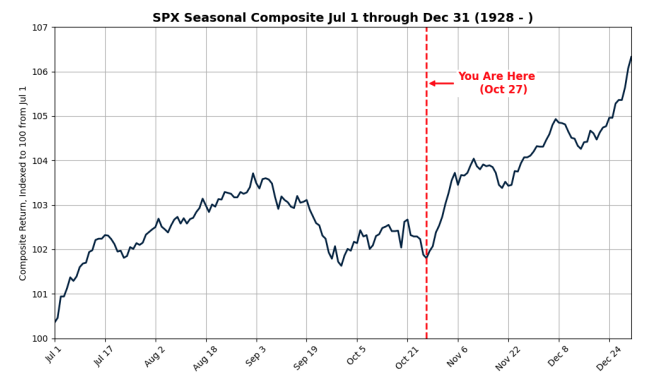

a. 今天开始是美国股票第四季度最佳交易期,数据追溯到1928年。10月28日是全年最佳交易日之一,并且是一个积极的季节性交易阶段,连续9天上涨。历史第47次创下新高是在10月18日:5864点,比今天的盘前开盘高出约20点。

b. Today begins the best trading period of the year for US equities also during election years.

c. Month-end will reduce supply from the largest sellers of the equity market: (mutual fund year-end and pension supply) and bring back online the largest buyer of the equity market, US Corporates. US Corporate repurchase window starts today with 50% of corporates in the open window.

d. Incoming client questions have shifted from hedging the left tail to the right tail. The VIX is down -1.13 points to 19.20, and there is room to add length if volatility drops further.

e. The global consensus on Wall Street is that we will dip after the election, and investors are waiting for the (-5%) dip to add. I do not think that we see this left tail.

f. I think that the US election will be a clearing event for risk assets, and re-risking may happen quickly (and out of favor sectors and themes that are under-owned).

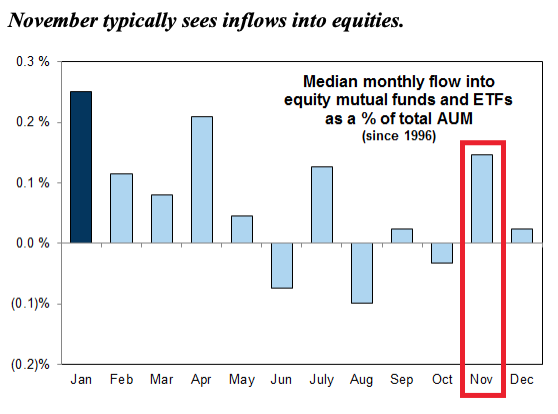

Target-date funds (TDFs), PWM allocations, and retail investors typically rebalance their portfolios in January, April, and November. Investors who have Treasury Bills rolling off may be looking for a new home. US fund flows since 2019: Cash $3.465 Trillion, Bonds $2.029 Trillion, and Equities $55 Billion

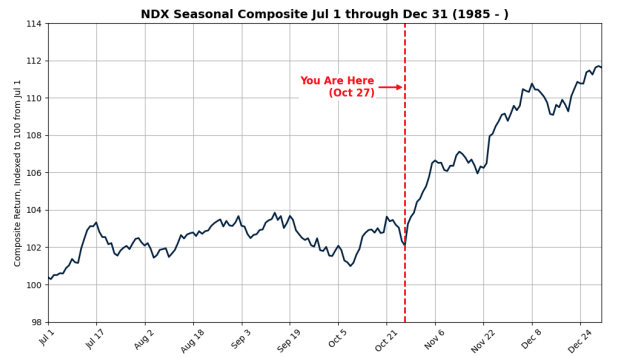

Seasonals - everyone loves a Year-End rally... (7 trading days to the US election). a. The median S&P 500 return from October 27th to December 31st is +5.22% since 1928. b. The median S&P 500 return from October 27th to December 31st in election years is +6.25% since 1928. c. The median NDX return from October 27th to December 31st is +11.74% since 1985. d. The median NDX return from October 27th to December 31st in election years is +7.17% since 1985.

免责声明:提供的材料仅供参考,不应视为投资建议。 本文中表达的观点,信息或观点仅属于作者,而不属于作者的雇主,组织,委员会或其他团体或个人或公司。

过去的业绩不代表未来的结果。

高风险警告:差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。 当与Tickmill UK Ltd和Tickmill Europe Ltd进行差价合约交易时,分别有72%和73%的零售投资者账户亏损。 您应该考虑自己是否了解差价合约的工作原理,以及是否有具有承受损失资金的的高风险的能力。

期货和期权:保证金交易期货和期权具有高风险,可能导致损失超过您的初始投资。这些产品并不适合所有投资者。请确保您完全了解这些风险,并采取适当的措施来管理您的风险。