SP500 LDN TRADING UPDATE 11/11/25

SP500 LDN TRADING UPDATE 11/11/25

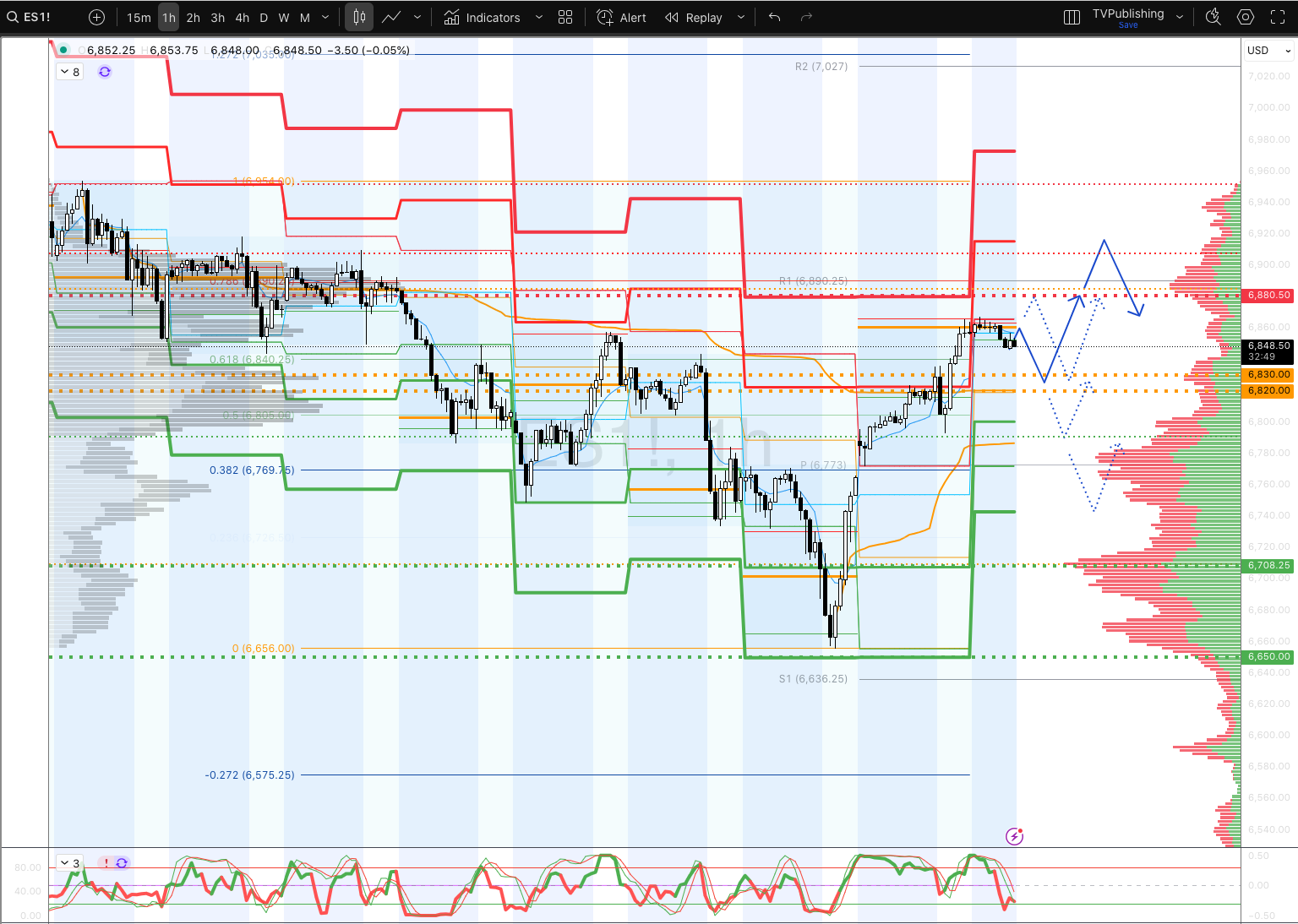

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6820/30

WEEKLY RANGE RES 6877/6629

NOV EOM STRADDLE 7054/6626

NOV MOPEX STRADDLE 6929/6399

DEC QOPEX STRADDLE 7054/6303

DAILY STRUCTURE – BALANCE - 6865/66655

DAILY BULL BEAR ZONE 6820/30

DAILY RANGE RES 6916 SUP 6799

2 SIGMA RES 6970 SUP 6743

DAILY VWAP BULLISH 6790

VIX BULL BEAR ZONE 18.5

TRADES & TARGETS

LONG ON ON TEST/REJECT DAILY BULL BEAR ZONE TARGET WEEKLY > DAILY RANGE RES

SHORT ON TEST REJECT WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOR: SKEPTICISM

S&P +154bps closing @ 6,832 w/ a of MOC +$115m to Buy. NDX +220bps @

25,611. R2K +127bps @ 2,463 and Dow +81bps @ 47,368. 17.9b shares traded across all US

equity exchanges vs ytd daily avg of 17.3b shares. VIX -7% @ 17.67, WTI Crude +72bps @

$60.18, US 10YR +1bp @ 4.11%, gold +268bps @ 4,117, dxy -3bps @ 99.57 and Bitcoin +1% @

$105.7k.

US stocks buoyed higher thanks to a snapback in momentum amidst Gov’t shutdown optimism, TSM reporting better monthly sales, and Jensen demand commentary re: more wafers for its Blackwell chips (GS High Beta Mo’ pair up ~5% today and up ~10% from mid-day Friday levels).

Convincing bounce for NDX off the 50-dma and now back within shouting distance of ATHs as the market tries to climb several ‘walls of worry’ into year-end. The Retail group substantial underperformer vs the market given the government re-opening is not an all-clear (consumer slowdown is not totally shutdown related). Elsewhere HC services were back to center ofcontroversy, with several Trump mentions over the weekend around the ACA subsidies and a negative comments around Health Insurers in general weighing on managed care and hospital stocks (OSCR -17%, CNC -8%, HCA -4%, THC -5%, etc).

Our floor was a 4 on a 1-10 scale in terms of overall activity levels. Our floor finished +129bps to buy vs a 30-day avg of -148bps. Institutional flows very quiet with volumes tracking -12% vs 20d avg ahead of Veteran's Day tomorrow (Bond holiday). Asset Mgrs finished small net sellers with supply in tech bellwethers vs smaller demand in discretionary. HFs finished small (+$600m) net buyers driven by demand in macro expressions of tech vs smaller supply in managed care.

DERIVS: With today's rally - we initially saw vols get hit as the market relaxed post the news of an imminent resolution to the govt shutdown. However, as S&P spot continues to realize to the upside, we're seeing vols go bid again at today's highs of the session. S&P put-call skew is offered, unwinding some of the recent nerves from last week. (Lee Coppersmith) November is historically the second largest execution month of the year with 10% of annual spend. GS corporate execution desk estimates $1tr worth of executed buybacks in 2025 which equates to over $6B worth of daily vwap demand for each November trading day. (GS Flow of Funds)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!